Building Financial Skills for Life

The Academy For Wealth Creators

Designed for students in grades 7-12, Tradechology Academy provides a solid foundation in financial literacy. With the latest tech, AI tools, and real-life trading simulations, students learn to save, budget, invest, and trade—all in a fun and interactive way.

Ask Lila — just click the mic.

Ask Lila — just click the mic.

Building Financial Skills for Life

Turning Students into Confident Investors

Designed for students in grades 7-12, Tradechology Jr. Academy provides a solid foundation in financial literacy. With the latest tech, AI tools, and real-life trading simulations, students learn to save, budget, invest, and trade—all in a fun and interactive way.

The Future Finance Series

Our Self-Paced Curriculum Tracks

for Our Participants

Tradechology:

Student Edition

40 Weeks

Monday - Friday

Sept 15 - May 29

Tradechology:

Familiy Edition

40 Weeks

Monday - Friday

Sept 15 - May 29

Adult Only Path: Financial Fluency Fast Track

12 Weeks

Monday - Sunday

Sept 15 - Dec 19

What Your Student Will Learn

Curriculum Overview:

Our curriculum introduces 7th–12th grade students to essential financial concepts using relatable,

real-world examples. Designed around the Fink Learning Model™, the course fosters lasting knowledge through interactive lessons, gamified simulations, and real-time trading tools. Students gain practical skills while exploring topics aligned with the National Standards for Personal Financial Education, ensuring both relevance and challenge.

National Standards We Align With:

Earning Income:

Understand how people earn money and the value of skills, education, and entrepreneurship.

Spending:

Learn how to plan, track, and evaluate spending habits for responsible financial choices.

Saving & Investing:

Explore savings plans, compounding interest, stocks, and futures trading.

Managing Credit:

Discover how credit works, why it matters, and how to use it wisely.

Managing Risk:

Identify strategies to protect personal assets and reduce financial risk.

Our Four Learning Pillars

Financial Foundations

Master budgeting, saving, and basic market concepts through engaging, real-world scenarios that resonate with students' interests and experiences.

Market Dynamics

Explore market trends, understand tax implications, and begin futures trading simulations with careful guidance and practical applications.

Trading Psychology

Develop emotional intelligence in trading, set meaningful financial goals, and create sustainable long-term planning strategies.

Portfolio Mastery

Apply learned concepts through hands-on portfolio management, risk assessment, and a comprehensive final project showcasing gained expertise.

Enrollment Details:

Program Dates:

Summer: July 7, 2025 - August 22, 2025

Fall: September 15, 2025 - May 29, 2026

Age Group: 7th - 12th Grade

ABOUT TRADECHOLOGY JR.

Tradechology Jr. equips students with the tools they need for financial independence and success in the real world.

The program goes beyond traditional financial education by focusing on both theoretical knowledge and real-world application. The curriculum incorporates relatable scenarios like sneaker reselling and tech gadget flipping to illustrate stock market concepts. It also emphasizes personal growth, emotional regulation, and building a healthy financial mindset through reflection activities and AI-powered support.

What Specific Skills Will Students Gain?

Foundational Financial Skills: Students will master essential financial concepts like budgeting, saving, investing, and understanding taxes, helping them build a solid foundation to manage their finances effectively throughout their lives.

Hands-on trading experience: Students will engage in realistic trading simulations for both stock & futures markets, gaining valuable experience in analyzing market trends and managing trades within a risk-free environment.

Critical emotional discipline: Students will learn how to manage emotions during financial decision-making, building the emotional resilience and rational thinking skills needed to navigate both market volatility and personal financial situations.

Reflection & self-improvement: Students will regularly reflect on their learning, connecting lessons to their personal goals, tracking their growth, and identifying areas for improvement for a deeper understanding of finance.

WHAT WE OFFER

How We Create Successful Young Investors

Course Curriculum

We provide a structured full school-year program covering financial literacy, budgeting, saving, investing, and an introduction to futures trading.

AI Tutor

Every student gets a 24/7 AI tutor that adapts to their pace and style, simplifying complex topics in a way that makes sense

to them.

Connect

Stay connected with quick updates on lessons and progress. Perfect for family money talks and tracking your

child's journey.

Virtual Trading

Practice investing with virtual money in our safe playground. Students learn from wins and losses through exciting challenges they can relate to.

Certified

Students earn badges, points, and rewards for completing milestones and mastering concepts, making financial literacy fun and engaging.

Community

Join young traders worldwide! Team up, share strategies, and learn about global markets with new friends.

Parents As Our Partners

We know that parents play a critical role in their child's education. At Tradechology we provide resources for you to support your student's learning journey, including:

Webinars

Join our interactive webinars to learn about the program, see what your child is learning, and find out how you can help reinforce these lessons together at home.

Progress Tracking

Easily track your child's progress through the Schoology platform, allowing you to stay updated on their journey toward financial empowerment.

Parent Portal

Parents can log in to see their children's information in one place, including grades, assignments, scores, attendance, schedules, and course bulletins.

Our Technology Partners

Tradechology utilizes several powerful platforms to enhance the learning experience

D2L Brightspace™

A future-ready learning management system designed to personalize education at scale, support every learner’s success, and streamline communication between students, educators, and families — all within a secure, intuitive platform.

Powerschool & Schoology™

An industry-leading education management system that creates a personalized learning hub, promotes equity and access, and enables seamless communication between students, teachers, and parents.

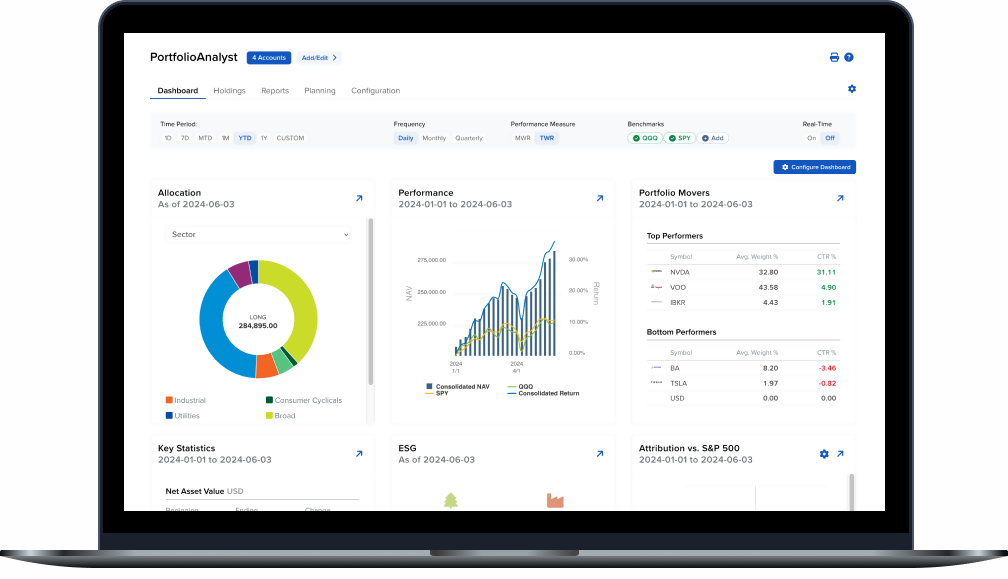

Interactive Broker's Student Trading Lab

This enterprise level trading platform gives students a risk-free environment to practice trading stocks, options, futures, bonds, and currencies using real-time market data.

Portfolio Analyst™

This robust portfolio analysis tool allows students to analyze their trading performance, track returns, and measure results against benchmarks.

Enrollment

What Comes With Enrollment

Full School-Year Program: A comprehensive, self-paced program covering personal finance, trading, and investing.

Self-Paced Learning: Students have the flexibility to learn at their own pace with high-quality video lessons on personal finance and trading concepts. This flexible schedule allows students to balance other activities, like sports, while revisiting complex topics as often as needed for a deeper understanding.

IBKR Student Trading Lab Suite: Gain access to Interactive Brokers' full suite of trading platforms and tools, including Trader Workstation (TWS), Client Portal, IBKR Mobile, and over 100 order types with advanced algorithmic trading.

Mentor Reviews: Personalized portfolio reviews and expert feedback from financial professionals utilizing the IBKR Student Trading Lab.

AI Assistant: 24/7 personalized guidance offering adaptive support, motivation, and a secure learning environment, ensuring each student stays engaged, confident, and on track throughout their financial education journey.

Gamified Learning: Points, badges, and rewards to keep students motivated and engaged throughout their learning journey.

Parental Resources: Parent webinars, a progress tracking system, and an online portal to stay informed and involved.

Discussion Forums: Structured peer discussions for collaborative learning.

Interactive Tools: Budgeting apps, trading simulators, and multimedia lessons for hands-on learning.

TUITION

Choose Your Enrollment Plan

STudent

Monthly Payments

$99

For independent learners building smart money habits.

Full access to core lessons and tools

Flexible, student-friendly schedules

Learn at your own pace—anytime, anywhere

Priority student support for fast answers

No contracts - cancel anytime

Family

monthly Payments

$149

Designed for families who want more involvement in education.

Parent dashboard for monitoring progress

Custom learning paths tailored to your child’s needs

Easy communication with course mentors

Progress tracking & shared goal setting

No contracts - cancel anytime

Adult ONLY

One Time Payment

$399

The best value for families with focused on education.

Lifetime access for multiple students

Shared family learning dashboards

Track goals and milestones

togetherFree updates and priority features

100% Money Back Guarantee

100% Money Back Guarantee

If you decide the program isn’t the right fit, inform us by July 31, 2025, and we will provide you a full refund. No questions asked.

The Tradechology Team

Marcus

Sheila

Edgar

Simone

Khuddus

Every parent says it...

'I wish I'd learned this when I was young.' Tradechology turns that wish into a reality for your child. This isn't just a financial course—we teach young traders to think differently, master complex financial skills, and embrace the same growth that so many adults only discover much later in life.

From managing multi-million dollar investment funds to coaching individual traders on performance and discipline, my journey has been one of continuous growth. As a financial educator, bestselling author, and investor, I’ve dedicated my career to breaking down the complexities of finance. All of this experience is now focused on helping young students excel through our program.

We've partnered with leaders of industry like PowerSchool™ and Interactive Brokers to offer a world-class education that transforms complex concepts into exciting opportunities for young minds.

Join us in empowering the next generation to take control of their financial future, unlocking potential that knows no bounds.

Marcus Howard

Cofounder, Tradechology

What are parents saying

"Programs like this is exactly what today’s kids need. Learning to trade and invest in a fun, structured way sounds amazing. I wish we had this growing up!"

— Nina F, Parent

"I love how they're approaching trading education. Making complex concepts accessible through interactive learning is exactly what Gen Z needs."

— Sheila H, Youth Education Researcher

I've spent years trying to get kids excited about financial concepts. When I heard about this, I thought...This is exactly what we've been waiting for

.

— Mr. Rodriguez, Financial Literacy Teacher

"This is exactly the kind of program our kids need right now! It's going to be a game-changer for this generation."

— Debbie A, K-12 Curriculum Developer

Got More Questions?

Explore Our FAQs

Here's what parents and future investing traders are asking about Tradechology.

How is Tradechology different from other financial programs?

Tradechology Jr. stands out because it combines real-world trading insights from an experienced hedge fund manager with a curriculum designed specifically for young learners. Unlike many traditional financial courses, our program focuses on hands-on learning, real-life examples, and psychological mastery—helping students understand not just the 'how' but the 'why' of financial decisions.

We’ve partnered with top industry leaders like PowerSchool™ and Interactive Brokers to create an environment that bridges complex financial concepts into relatable and empowering lessons, giving young traders the head start that many adults wish they'd had.

How does Tradechology boost my child's thinking skills?

Tradechology enhances your child's thinking skills by leveraging an innovative approach grounded in the Fink Learning Model, which focuses on integrated learning experiences. Our curriculum isn't just about understanding financial concepts—it’s designed to develop critical thinking, problem-solving, and the ability to apply knowledge in real-world scenarios. By engaging students in activities that connect finance to everyday experiences, we make learning deeply personal and transformative.

Will my child work with students from different backgrounds?

Absolutely! Tradechology Jr. brings together young learners from diverse backgrounds, creating a vibrant and inclusive learning environment. We believe that financial education should be accessible to everyone, and our community reflects that belief. Students will have the opportunity to collaborate with peers from different cultures, experiences, and perspectives, enriching their understanding and helping them learn the value of multiple viewpoints—essential skills for thriving in today’s interconnected financial world.

My child loves gaming - will they enjoy this?

If your child loves gaming, they'll likely enjoy Tradechology Jr. as well. Our program incorporates elements that resonate with gamers—strategy, quick decision-making, risk-reward evaluations, and a challenge-based approach to learning. Just like in gaming, students learn how to plan moves, adapt to changing scenarios, and think critically about their actions.

How can I support my child's learning journey?

Supporting your child's journey with Tradechology Jr. means being actively involved in their learning process. Encourage their curiosity by discussing what they're learning, and ask them to share their insights with you. Providing a space for regular study, showing enthusiasm for their progress, and celebrating their achievements—big or small—will help keep them motivated.

How do you track teamwork and progress?

Our program tracks teamwork and progress through a combination of mentors, IBKR student labs, and our dedicated parent portal. Mentors work closely with students in the Interactive Brokers student labs, providing hands-on guidance and personalized feedback.

The parent portal offers real-time progress tracking and insights, ensuring parents stay informed and involved in their child's development. With these resources, we ensure each student receives the support and monitoring they need to excel in their financial education.

Will this improve my child's communication skills?

Our program also focuses on enhancing communication skills through collaborative projects, discussion-based learning, and presentations. Students work together in IBKR student labs, guided by mentors who encourage clear, effective communication.

These activities help students build confidence in expressing their ideas, whether working in teams or presenting their strategies. With the support of mentors, collaboration, and consistent feedback, we ensure that your child's communication abilities grow alongside their financial skills.

How does Tradechology ensure my child’s safety?

Safety is our top priority at Tradechology Jr. We ensure your child's safety through secure, monitored learning environments, both online and during any interactive sessions.

All mentors undergo background checks, and our digital platforms are designed with privacy controls to protect students' information. Additionally, the IBKR student labs are conducted under strict supervision to maintain a safe and supportive atmosphere for all participants.

How is my child’s privacy protected?

We use PowerSchool, a leading provider of K-12 education technology solutions, to manage the application process and ensure data security.

PowerSchool is dedicated to protecting student data, using extensive security measures to maintain confidentiality, integrity, and availability of all information. Key security measures include:

SOC 2 Compliance: PowerSchool undergoes annual System and Organization Controls (SOC) 2 Type 2 examinations, ensuring strict controls on security, availability, and confidentiality.

ISO/IEC 27001:2013 Certification: This certification demonstrates PowerSchool's commitment to securing both applications and customer data, providing reassurance for all users.

24/7 Security Operations Center (SOC): PowerSchool provides continuous monitoring to protect against potential threats, ensuring your child's data remains secure at all times.

Tradechology Jr's platform is fully COPPA-compliant, ensuring that schools have obtained parental consent. Parents have full rights to access, update, or delete their child’s information by contacting the school administrator or Tradechology Jr’s support team.

We allow parents to consent to the use of their child’s data without authorizing its disclosure to third parties. This gives you control over your child’s information and ensures it’s only used for educational purposes.

Tradechology and its representatives are not Financial Advisors or a Broker/Dealer: Neither Tradechology nor any of its officers, employees, representatives, agents, or independent contractors are, in such capacities, licensed financial advisors, registered investment advisers, or registered broker-dealers. Tradechology does not provide investment or financial advice or make investment recommendations, nor is it in the business of transacting trades, nor does it direct client commodity accounts or give commodity trading advice tailored to any particular client’s situation. Nothing contained in this communication constitutes a solicitation, recommendation, promotion, endorsement, or offer by Tradechology of any particular security, transaction, or investment.

Securities Used as Examples: The securities used in this example are used for illustrative purposes only. The calculation used to determine the return on investment “ROI” does not include the number of trades, commissions, or any other factors used to determine ROI. The ROI calculation measures the profitability of investment and, as such, there are alternate methods to calculate/express it. All information provided are for educational purposes only and does not imply, express, or guarantee future returns. Past performance shown in examples may not be indicative of future performance. Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success.

Investing Risk: Trading securities can involve high risk and the loss of any funds invested. Investment information provided may not be appropriate for all investors and is provided without respect to individual investor financial sophistication, financial situation, investing time horizon, or risk tolerance.

Testimonials appearing on this website may not be representative of other clients or customers and is not a guarantee of future performance or success